Post Office SCSS Scheme: When it comes to secure and predictable investment options in India, the Post Office continues to be the preferred choice for many. Among the many savings plans it offers, the Senior Citizen Savings Scheme (SCSS) stands out as a dependable source of quarterly income, providing stability for individuals in their retirement years. With assured returns, a government guarantee, and attractive quarterly interest, SCSS has become an important part of retirement planning for countless families.

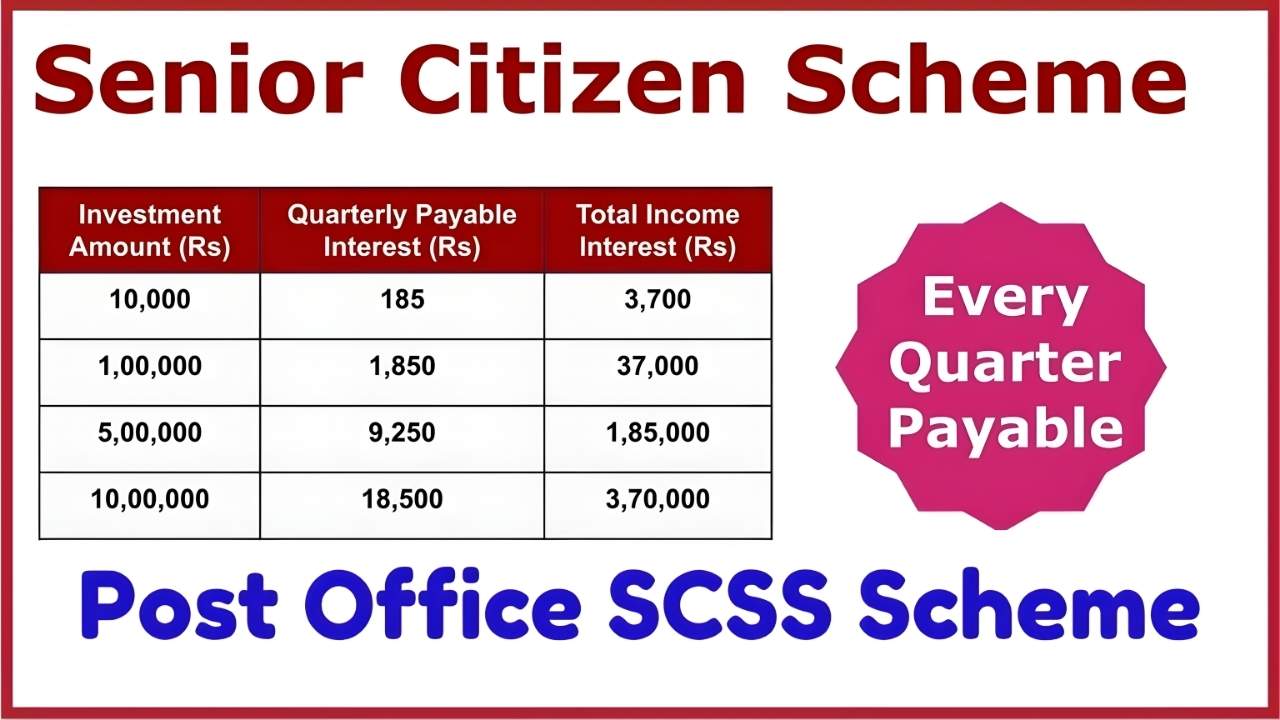

SCSS Key Details and Quarterly Income Table

| Particulars | Details |

|---|---|

| Scheme Name | Senior Citizen Savings Scheme |

| Eligibility | Individuals aged 60+, VRS retirees 55–60 years, certain defence personnel |

| Minimum Investment | ₹1,000 |

| Maximum Investment | ₹30,00,000 |

| Current SCSS Interest Rate | 8.2 percent per annum |

| Quarterly Payout on ₹15 lakh | Approximately ₹30,749 |

| Tenure | 5 years, extendable by 3 years |

| Tax Benefit | Eligible under Section 80C up to ₹1.5 lakh |

What is the Senior Citizen Savings Scheme

The Senior Citizen Savings Scheme is a government-supported investment plan created to provide financial comfort to individuals above the age of 60. The scheme gives guaranteed interest income every quarter, making it ideal for retirees who want predictable cash flow without worrying about market fluctuations. Since the investment is backed by the Government of India, it offers full security and stability.

Who Can Invest in SCSS

This scheme is primarily for senior citizens aged 60 and above. However, individuals between 55 and 60 years who have opted for voluntary retirement can also participate if they invest within one month of receiving their retirement benefit. Additionally, certain categories of defence personnel may open an SCSS account at an earlier age based on government rules. This wide eligibility makes it convenient for early retirees and individuals seeking low-risk income options.

Investment Limits and Tenure

SCSS allows deposits ranging from ₹1,000 to ₹30 lakh. The scheme has a fixed tenure of 5 years, which can be extended for an additional 3 years after maturity. This structure allows retirees to plan long-term income while keeping their investment stable and secured.

SCSS Interest Rate and Quarterly Payouts

One of the biggest attractions of the Senior Citizen Savings Scheme is its high interest rate. The current SCSS interest rate is 8.2 percent per annum, which is considerably higher than most bank fixed deposits. The interest is paid every quarter, ensuring that investors receive a steady income at regular intervals. This makes the scheme extremely helpful for managing routine expenses post-retirement.

How ₹30,749 is Earned Every Quarter

To understand the benefits clearly, let us look at the quarterly earnings. If an investor deposits ₹15 lakh under SCSS, the yearly interest amounts to ₹1,23,000. When divided quarterly, this results in a payout of approximately ₹30,749 every three months. This consistent income supports senior citizens in meeting daily financial needs without depending on others.

Tax Benefits Under SCSS

Investments under the Senior Citizen Savings Scheme are eligible for tax deduction under Section 80C of the Income Tax Act, with a maximum limit of ₹1.5 lakh. However, the interest received from SCSS is taxable as per the individual’s tax slab. If the annual interest exceeds ₹50,000, tax is deducted at source (TDS). Retirees should keep this in mind while planning their yearly income and tax obligations.

How to Open an SCSS Account

Opening an SCSS account is straightforward. Investors can apply at any post office or authorized bank. Required documents include age proof, PAN, Aadhaar, photographs, and the filled application form. Once the initial deposit is made, the account is activated and quarterly interest payments begin automatically. Many post offices and banks now offer digital tracking for added convenience.

Why SCSS is Better Than Regular Fixed Deposits

Although many banks offer fixed deposits, SCSS provides a superior advantage for senior citizens. The interest rate is higher, the payouts are quarterly, and the investment is protected by a government guarantee. While bank fixed deposits may offer varying rates and fewer tax benefits, SCSS provides predictable and reliable income, making it more suitable for people looking for long-term financial safety after retirement.

Important Points to Consider Before Investing

Even though SCSS is highly reliable, investors should be aware of certain rules. The maximum limit of ₹30 lakh cannot be exceeded across all SCSS accounts combined. Premature closure is allowed but involves penalties. Since interest earned is taxable, individuals in higher tax slabs must calculate their net income before investing a large amount. It is also advisable to diversify investments if one has substantial retirement savings.

Final Verdict

The Senior Citizen Savings Scheme is an excellent investment choice for retirees who want guaranteed returns, steady quarterly income, and full security. With a quarterly payout of around ₹30,749 on a ₹15 lakh investment, it supports daily expenses comfortably and ensures peace of mind. The government backing, attractive SCSS interest rate, and easy account-opening process make it one of the most dependable options for retirement planning in India.

Disclaimer

This article is for informational purposes only. SCSS rules, interest rates, and tax provisions may change based on government notifications. Readers should verify the latest details from official India Post or Ministry of Finance sources before making any investment decisions.