Post Office RD Scheme 2025: Every individual dreams of securing their hard-earned money in a safe place to meet future needs. While banks and private companies offer investment options, they often carry risks. In contrast, Post Office savings schemes are completely safe as they are backed by the Government of India. Among these, the Post Office Recurring Deposit (RD) Scheme is a simple and reliable way to build a substantial fund through small monthly contributions.

Post Office RD Scheme Key Details Table

| Feature | Details |

|---|---|

| Scheme Name | Post Office Recurring Deposit (RD) |

| Managed By | Department of Posts, Government of India |

| Minimum Monthly Deposit | ₹100 |

| Maximum Monthly Deposit | ₹5,000 |

| Interest Rate | 6.7% per annum (compounded quarterly) |

| Tenure | 60 months (5 years) |

| Eligibility | Indian citizens above 18 years |

| Total Investment Example | ₹5,000 per month for 5 years = ₹3,00,000 |

| Estimated Maturity Amount | ₹3,56,830 |

| Security | Fully government-backed, risk-free from market fluctuations |

What is the Post Office RD Scheme?

The Post Office RD Scheme allows investors to deposit a fixed amount every month for a specified period, usually five years. At the end of the tenure, the depositor receives the total contributions along with accrued interest. Since the scheme is run by the postal department, it is fully secured by the government, ensuring the principal and interest remain protected.

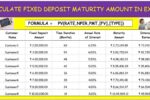

Example of Returns and Interest Calculation

Suppose an investor deposits ₹5,000 every month for five years. The total contribution over this period would be ₹3 lakh. At the current interest rate of 6.7 percent per annum, compounded quarterly, the accumulated interest would be around ₹56,830. Therefore, the total maturity amount after five years would be approximately ₹3,56,830. This demonstrates how consistent small investments can grow into a considerable fund.

Why This Scheme is Safe

The Post Office RD Scheme is fully government-backed, which eliminates market-related risks. Unlike mutual funds or other private investments, there is no chance of losing capital. This makes the scheme ideal for anyone seeking secure returns with guaranteed interest. It is a trusted option for conservative investors who prioritize safety over high-risk gains.

Who Can Invest

The scheme is open to all Indian citizens above 18 years of age. Salaried professionals, homemakers, and parents planning for their children’s education or marriage can benefit from it. It is suitable for individuals with any income level who want to steadily grow their savings over time.

How to Open an RD Account

Opening an RD account is straightforward. Visit your nearest post office branch, collect and fill out the application form, and submit the required documents. The first monthly installment is deposited at the time of account opening. Afterward, the investor continues to deposit the chosen monthly amount for the next 60 months. At maturity, the account holder receives both the total deposited amount and the interest earned.

Final Verdict

The Post Office RD Scheme is one of the most secure and reliable ways to save money systematically. With government backing, fixed interest rates, and the power of compounding, even modest monthly contributions can grow into a substantial corpus over five years. This scheme is ideal for anyone looking for a safe, disciplined, and convenient savings plan for future financial needs.

Disclaimer

This article is intended for general informational purposes only. Interest rates, terms, and conditions may change as per government notifications. Investors should consult the nearest post office or a qualified financial advisor for the latest updates before investing.