Post Office NSC Scheme: Investing wisely has become essential for individuals who want financial stability in the future. As living expenses rise and long-term planning becomes more important, people are steadily turning toward safe investment options that offer guaranteed returns.

Among the most reliable choices available today, the Post Office National Savings Certificate (NSC) Scheme holds a special place because of its government backing and predictable earnings. Many investors are often surprised to learn that with proper planning, the NSC can help build a substantial corpus, even reaching close to 58 lakh rupees within a span of five years.

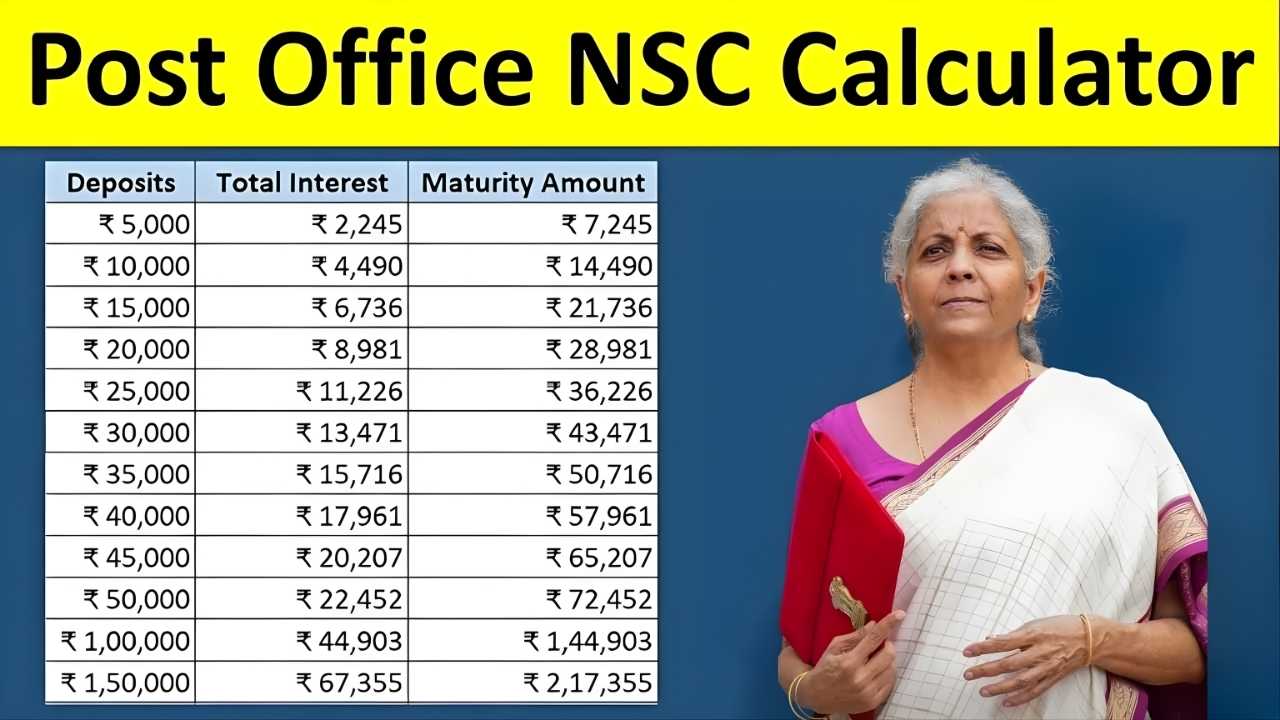

Post Office NSC Investment Overview Table

| Investment Component | Details |

|---|---|

| Scheme Name | Post Office National Savings Certificate (NSC) |

| Tenure | 5 Years |

| Interest Rate | Revised Quarterly by Government |

| Compounding | Annually |

| Minimum Investment | No fixed minimum (small amount accepted) |

| Maximum Investment | No upper limit |

| Tax Benefit | Up to ₹1.5 lakh under Section 80C |

| Risk Level | Zero risk (Government-backed) |

What is the Post Office NSC Scheme

The National Savings Certificate is a fixed-income savings product offered by India Post. It caters to individuals who prefer secure and assured growth rather than market-linked fluctuations. The scheme has a fixed maturity period of five years, and since the returns are predetermined, investors know the exact amount they will receive upon maturity. Being backed entirely by the Government of India, it eliminates the fear of losing the invested amount and is ideal for cautious investors.

Key Features of NSC

The Post Office NSC Scheme includes several attractive features that make it a popular choice. It allows people from all income levels to invest comfortably because the minimum deposit is small. There is also no maximum limit, which means investors can contribute as per their financial goals. Another major advantage is that the interest gets compounded annually and paid out at maturity, helping the investment grow faster. Contributions made are eligible for tax deductions under Section 80C, providing additional financial benefits.

How NSC Helps Build a Large Corpus

Creating a sizable fund such as 58 lakh rupees in five years is possible through a systematic and disciplined investment approach. If an investor reinvests the maturity amount into new NSC certificates or invests a significant lump sum initially, the power of compounding ensures that the money grows steadily. As interest accumulates every year and gets reinvested automatically, the final amount becomes substantially larger by the end of the term.

NSC Returns Calculation for 5 Years

The final maturity value is influenced by the NSC interest rate, which often remains higher than bank savings accounts or short-term deposits. For example, at an approximate interest rate of 7.7 percent annually, a well-planned investment strategy with reinvestments can help an investor reach close to 58 lakh rupees in five years. The key is consistency and allowing the investment to grow without early withdrawals.

Why Choose NSC Over Other Investments

While options like mutual funds, equity trading, and bank fixed deposits exist, they do not offer the same level of security as NSC. Market-based investments carry volatility and require careful monitoring. Fixed deposits, though stable, usually offer lower returns than NSC. On the other hand, the Post Office NSC Scheme provides a steady interest rate, guaranteed returns, and complete capital protection, making it ideal for individuals who prioritize safety.

Tax Benefits Under NSC

One of the biggest advantages of NSC is its tax-saving feature. Under Section 80C of the Income Tax Act, investors can claim deductions up to ₹1.5 lakh per financial year. Additionally, the yearly interest (except in the last year) is considered reinvested, allowing further tax benefits. This double advantage boosts the total return and enhances wealth creation.

Steps to Invest in NSC

Opening an NSC investment is straightforward. Interested individuals can visit any nearby post office with identity proof, address proof, and a photograph. The certificate can be taken either physically or in electronic form. The process requires minimal documentation, making it convenient even for beginners.

Who Should Invest in NSC

The National Savings Certificate is suitable for a wide range of investors. Salaried individuals seeking tax deductions, parents planning for their children’s education, and retired individuals wanting safe returns all find this scheme beneficial. It is also ideal for people who prefer guaranteed earnings over market risks.

Final Verdict

The Post Office National Savings Certificate is a reliable and straightforward investment option that offers safety, decent returns, and tax benefits. With disciplined investment and strategic reinvestment, building a corpus close to 58 lakh rupees in just five years is achievable. For individuals seeking security, predictable returns, and government assurance, the NSC remains one of the most dependable savings instruments in India.

Disclaimer

The information in this article is intended for general awareness. Interest rates, maturity amounts, and investment rules for the Post Office NSC Scheme may change based on government updates. Investors should verify the latest details from official sources or consult a financial advisor before making any investment decisions.