Post Office Monthly Income Scheme 2025: The Post Office Monthly Income Scheme (MIS) remains one of the most trusted savings options for conservative investors, retirees, and homemakers in India. Known for providing regular income along with government-backed security, the MIS is ideal for those who prioritize stability over high-risk investments. In 2025, this scheme continues to attract attention for its assured monthly payouts and ease of access.

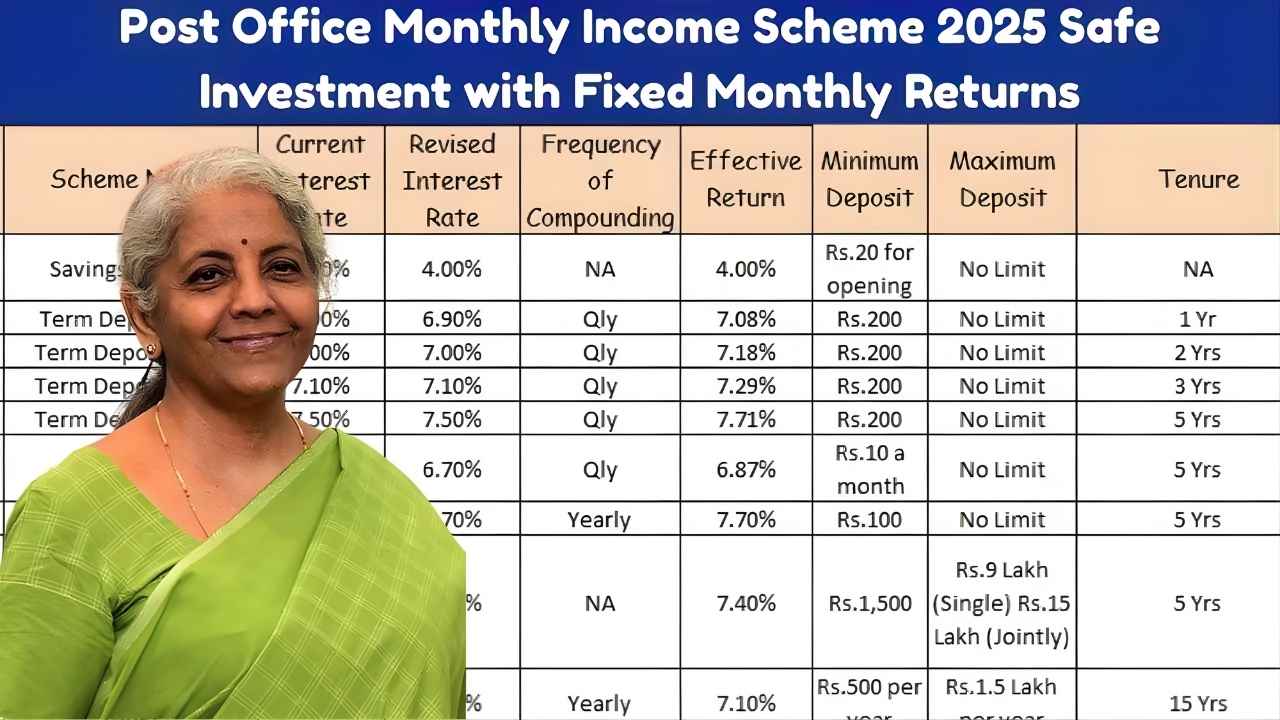

Post Office Monthly Income Scheme 2025 Features Table

| Feature | Specification |

|---|---|

| Minimum Investment | ₹1,000 |

| Maximum Investment | ₹9 lakh (single), ₹15 lakh (joint) |

| Tenure | 5 years |

| Interest Rate | Fixed, revised quarterly by government |

| Monthly Payout | Direct credit to post office or bank account |

| Premature Withdrawal | Allowed with penalty (1–2%) after 1 year |

| Nomination Facility | Available |

| Tax Benefits | Interest taxable, no 80C deduction |

What is the Post Office Monthly Income Scheme

The Monthly Income Scheme allows investors to deposit a lump sum and earn a guaranteed monthly income in the form of interest. Backed by the Government of India, it ensures complete safety of both principal and returns. The scheme is designed for individuals who need a steady cash flow without exposing their money to market volatility.

Key Features of Post Office MIS 2025

MIS in 2025 is designed for small and medium investors seeking stability. The minimum deposit is ₹1,000, and investors can deposit in multiples of 100. With a five-year tenure and government-determined interest rate revised quarterly, MIS balances attractive returns with security. Joint accounts allow multiple people to invest together, making it ideal for families.

Who Should Consider MIS

Retirees, senior citizens, homemakers, and conservative investors benefit most from MIS. Parents can also use it to create a safe income source for household expenses. Those looking to avoid market risk find MIS particularly appealing due to its predictable monthly payouts.

Benefits of MIS 2025

The Post Office MIS guarantees fixed monthly returns, offering peace of mind compared to market-linked investments. Investors also benefit from joint account options, nominee facilities, and the flexibility of reinvesting after maturity.

Liquidity and Premature Withdrawal

Though MIS has a five-year tenure, premature withdrawals are allowed. No interest is paid if withdrawn within the first year. Between 1–3 years, a 2% penalty is applied, and after three years, a 1% penalty applies. This ensures some liquidity without compromising long-term saving discipline.

How Monthly Income is Paid

Monthly payouts are credited directly to the investor’s post office account or linked bank account, providing a steady income for household expenses, pensions, or personal needs.

Comparison with Other Schemes

Unlike bank FDs that pay interest quarterly or at maturity, MIS ensures a monthly income. Compared to mutual funds or equities, MIS eliminates the risk of capital loss, making it ideal for risk-averse investors seeking predictable returns.

Taxation on MIS Returns

Interest earned under MIS is fully taxable and added to the investor’s total income. While there is no Section 80C benefit for the invested amount, the scheme remains attractive for low-tax bracket investors due to its stability and government guarantee.

MIS as a Retirement Planning Tool

For retirees, MIS is an excellent supplement to pensions, providing regular income to manage day-to-day expenses. Its five-year maturity aligns well with medium-term financial planning, and reinvestment options ensure a continuous income cycle. Combining MIS with schemes like the Senior Citizen Savings Scheme can create a diversified, secure investment portfolio.

Why Choose Post Office for MIS

India Post’s extensive network ensures accessibility even in rural and semi-urban areas. Combined with trust, transparency, and simple procedures, MIS through post office remains one of the easiest and most reliable investment tools in India.

Final Verdict

The Post Office Monthly Income Scheme 2025 is a safe, dependable, and straightforward investment option for anyone seeking guaranteed monthly returns. It is especially suited for retirees, homemakers, and conservative investors who prioritize security over high returns. With government backing, flexible options, and predictable payouts, MIS continues to be one of India’s most reliable income-generating schemes.

Disclaimer

This article is for educational purposes only. Interest rates, rules, and features of the Post Office MIS are subject to change as per government notifications. Investors should verify the latest details from India Post or consult a licensed financial advisor before making any investment decisions.