Post Office Monthly Income Scheme 2025: For Indian investors seeking safety, assured income, and full government protection, the Post Office Monthly Income Scheme (MIS) remains a reliable investment option. In 2025, this scheme continues to offer a dependable way to generate fixed monthly income, making it particularly suitable for senior citizens, homemakers, and individuals looking for steady cash flow without exposure to market risks.

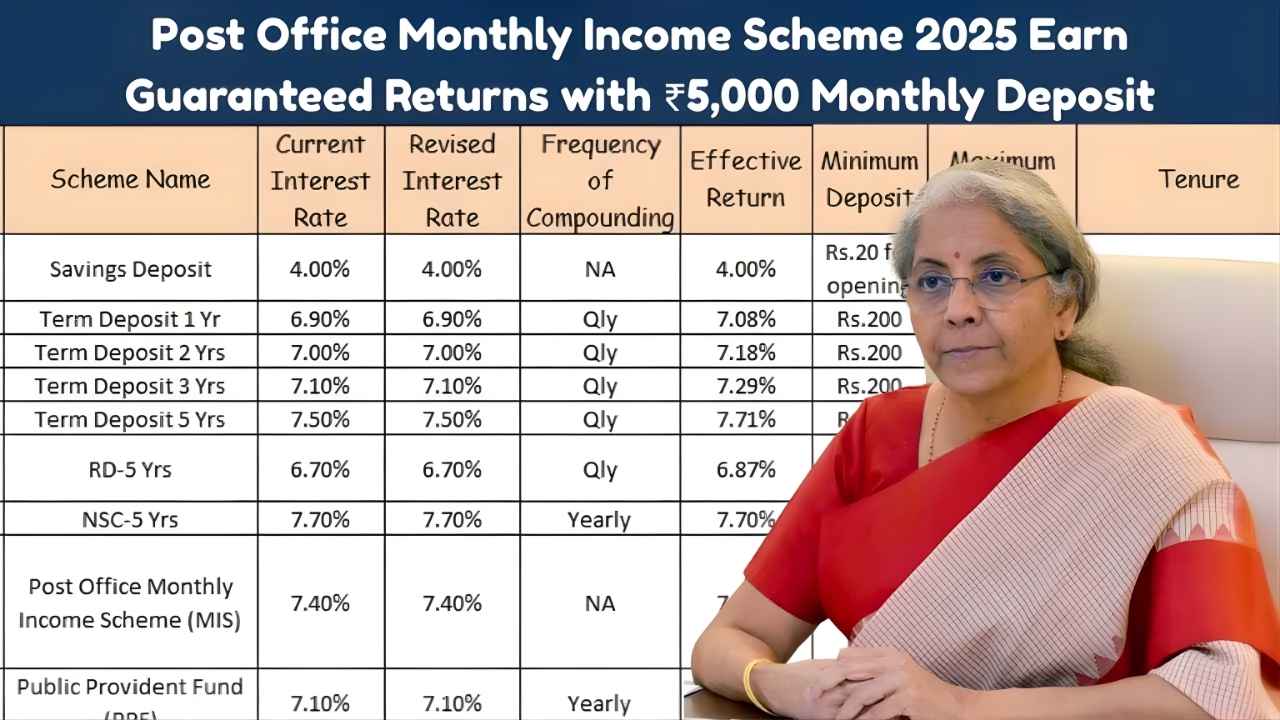

Post Office Monthly Income Scheme 2025 – Key Interest Rates and Benefits

| Feature | Details |

|---|---|

| Minimum Investment | ₹1,500 |

| Maximum Investment | ₹9,00,000 (Single), ₹15,00,000 (Joint) |

| Tenure | 5 Years |

| Interest Rate (2025) | 7.4% per annum |

| Interest Payout | Monthly |

| Tax Benefit | None; interest taxable as per income slab |

| Eligibility | Resident Indian citizens (single/joint accounts); minors via guardians |

| Premature Withdrawal | Allowed after 1 year with penalty |

How the Post Office Monthly Income Scheme Works

Investors deposit a lump sum amount in the MIS for a fixed tenure of five years. Interest is calculated at the prevailing rate and paid out every month directly to the account holder, while the principal is returned at maturity. For instance, a single account with a maximum investment of ₹9 lakh would earn approximately ₹5,500 monthly interest, providing a stable source of income without touching the original capital.

Example of Returns on Monthly Investment

Suppose an investor deposits ₹5,000 every month into the MIS. Over the 5-year tenure, the total investment will sum to ₹3,00,000. The monthly interest payouts continue throughout the period, and at maturity, the full principal is returned. This ensures a dual advantage: regular income and complete capital safety.

Eligibility and Account Opening

The scheme is open to all resident Indian citizens. Single accounts can be opened by adults, while joint accounts may include up to three individuals. Accounts for minors can be opened by parents or legal guardians. Non-resident Indians are not eligible. To open an account, investors need identity proof, address proof, passport-size photographs, and the initial deposit. Many post offices now also offer digital account opening through India Post Payments Bank, providing convenience for modern investors.

Benefits of the Post Office MIS

- Complete safety of principal due to government backing

- Regular monthly income ideal for retirees and homemakers

- Higher interest rates than typical savings accounts

- Easy transfer of accounts across post offices in India

- Nomination facility ensures smooth inheritance to family members

Tax Implications

Interest earned from the Post Office MIS is fully taxable according to the investor’s income tax slab. There is no tax deduction available under Section 80C for the deposit amount. Investors should plan accordingly if they fall in higher tax brackets.

Limitations to Consider

- Fixed interest rate does not protect against inflation

- Lock-in period of 5 years with limited premature withdrawal options

- Returns may be lower than inflation-adjusted market-linked instruments

- No additional tax benefits

Who Should Invest in Post Office MIS

This scheme is particularly suitable for senior citizens seeking monthly income post-retirement, homemakers requiring regular household cash flow, conservative investors preferring secure returns, and salaried professionals seeking a secondary source of income. Its government guarantee and simplicity make it a dependable choice for anyone valuing safety over high-risk investments.

Final Verdict

The Post Office Monthly Income Scheme in 2025 remains one of India’s most trusted small savings plans. With government backing, guaranteed monthly payouts, and principal security, it provides peace of mind for conservative investors. While it may not offer tax benefits or inflation-beating returns, it is ideal for individuals seeking financial stability and a steady flow of income.

Disclaimer

The content provided here is for informational purposes only. Interest rates, rules, and policies are subject to change as per government notifications. Investors should verify the latest details at their nearest post office or through the official India Post website before making any investment decisions.