Post Office Life Insurance Scheme 2025: The Indian Post Office has always been more than a network for sending letters or parcels. For generations, it has acted as a bridge for delivering essential financial services to millions of citizens, especially in regions where banking and private insurance access is limited. Post Office Life Insurance Scheme 2025 continues this mission by providing simple, transparent, and reliable insurance options that fit the needs of today’s families.

Key Post Office Life Insurance Plans 2025 Table

| Plan Name | Type of Coverage | Age Eligibility | Key Features |

|---|---|---|---|

| Whole Life Assurance | Lifetime financial cover | 19 to 55 years | Protection plus long-term savings |

| Endowment Assurance | Life cover + maturity benefit | 19 to 55 years | Lump sum return after maturity |

| Convertible Whole Life | Whole life plan convertible to endowment | 19 to 50 years | Flexibility to switch later |

| Joint Life Assurance | Plan for couples | 19 to 55 years | Combined cover under one policy |

| Anticipated Endowment (Money Back) | Periodic survival benefits | 19 to 45 years | Ideal for milestones like education and marriage |

| Yugal Suraksha | Joint savings + security | 19 to 55 years | Savings and protection for married partners |

Introduction to Post Office Life Insurance Scheme

Also known as PLI, India Post Life Insurance was introduced in 1884 and originally meant for postal employees. With time, its reach expanded to government workers, professionals, and now various segments of the general public. Since it is fully supported by the Government of India, it has become one of the safest insurance choices in the country.

What Makes the Scheme Unique

The Post Office Life Insurance Scheme 2025 is built to offer financial support to families in case of the policyholder’s death while also promoting disciplined long-term savings. With post offices spread across almost every village and town, people can easily buy, manage, and track their policies without complicated procedures.

PLI Plans Offered in 2025

India Post Insurance offers plans for people with different goals. Some focus on pure life protection, while others combine insurance with savings, investment growth, and wealth creation. In 2025, the available plans include whole life options, endowment plans, convertible policies, term assurance, and money-back plans with guaranteed benefits and bonuses.

Benefits of Post Office Life Insurance Scheme 2025

One of the strongest advantages of PLI Plans is that they are guaranteed by the Government of India, ensuring complete safety of savings. The premiums are lower than most private insurers and offer attractive bonus rates declared periodically. Many plans also allow policy loans after a set duration, making the scheme useful during financial emergencies.

The scheme helps families prepare for future commitments such as children’s education, marriage expenses, retirement planning, or wealth accumulation.

Eligibility Criteria

PLI coverage is available to Indian citizens who meet the prescribed age and medical fitness conditions. Initially restricted to government employees, the Post Office Life Insurance Scheme 2025 now covers many professional categories, salaried workers, and some self-employed individuals.

Age eligibility and medical rules differ based on the type of policy selected.

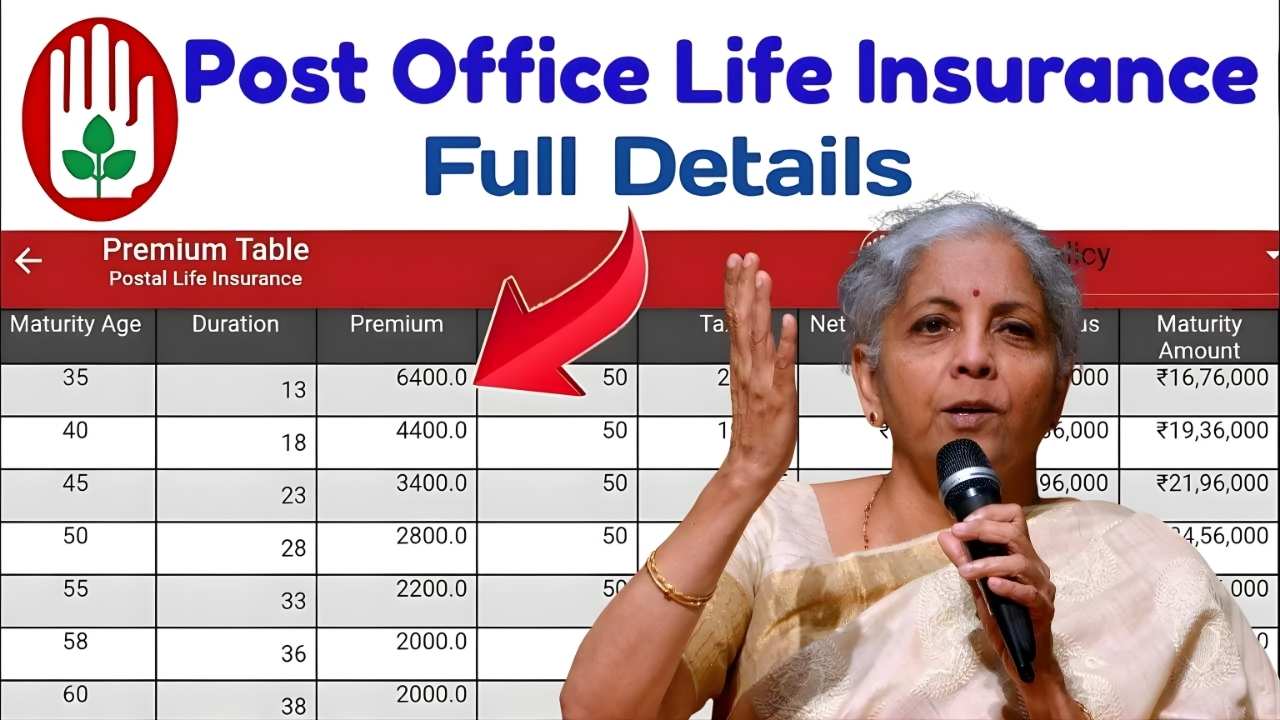

Premiums and Payment Options

Premiums under Post Office Insurance are affordable and depend on the chosen plan, age, and sum assured. Payments can be made monthly, quarterly, half-yearly, or annually. India Post also provides online premium payment facilities, making it convenient for policyholders who prefer digital services.

Application Process for PLI 2025

To apply, individuals can visit the nearest post office and fill out the proposal form with basic personal and medical details. If required, a medical examination is scheduled based on age and coverage amount. Once verified, the policy is issued.

Customers can also apply online through the India Post Insurance Portal, which simplifies the process for urban and working customers.

Why Post Office Life Insurance Is a Trusted Choice

People prefer PLI because it offers safety, lower premiums, generous bonuses, and easy access across India. With one of the nation’s largest service networks, even families in rural areas can receive assistance without relying on private financial institutions. The simplicity and transparency of the scheme make it ideal for first-time insurance buyers.

Challenges and Future Roadmap

Although PLI enjoys a strong reputation, lack of awareness is still an obstacle, especially in rural sectors. Many people do not know about the full range of plans available under the Post Office Life Insurance Scheme 2025. Digital adoption is improving but needs further enhancement to match the expectations of younger policyholders. With more awareness campaigns, improved online tools, and user-friendly services, PLI has the potential to grow significantly in the coming years.

Final Verdict

Post Office Life Insurance Scheme 2025 remains one of the most reliable, affordable, and transparent insurance options for Indian families. With its government guarantee, multiple plan choices, low premiums, assured bonuses, and easy claim settlement, it offers a complete financial protection package. For anyone seeking long-term security, savings, and peace of mind, India Post Life Insurance stands out as a dependable and value-rich choice.

Disclaimer

This rewritten article on Post Office Life Insurance Scheme 2025 is for educational and informational purposes only. Policy terms, premiums, eligibility conditions, and bonus rates may change according to official guidelines issued by India Post or the Government of India. Readers are advised to verify the latest updates from authorized post office branches or the official India Post Insurance website before making financial decisions.