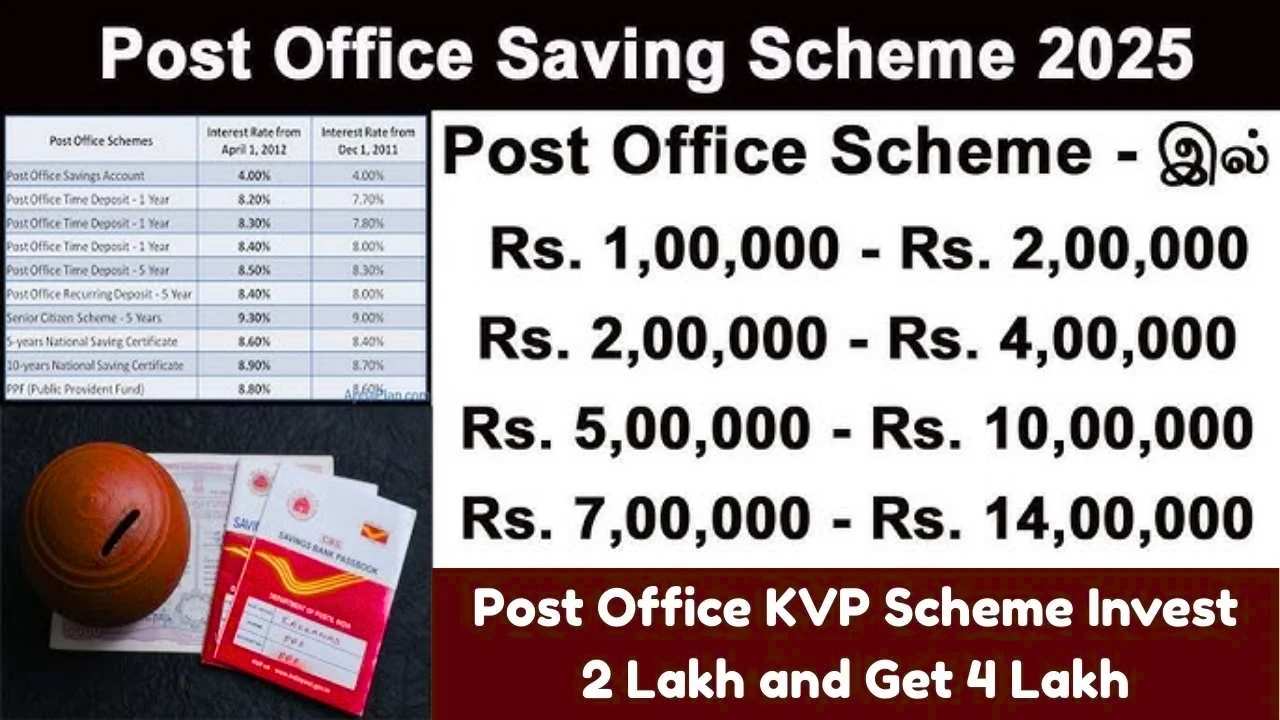

Post Office KVP Scheme: The Indian Post Office continues to be one of the most trusted financial institutions for small and medium savers. Among its various savings programs, the Kisan Vikas Patra stands out as a simple and secure scheme that allows your investment to double over a fixed period. If you are curious about how a deposit of 2 lakh rupees can grow to 4 lakh, understanding the interest rate, time period, and overall benefits of KVP is essential.

KVP Maturity Table for 2 Lakh Investment

| Investment Amount | Interest Rate | Maturity Period | Maturity Value | Key Feature |

|---|---|---|---|---|

| ₹2,00,000 | 7.5 percent | 115 months (9 years 7 months) | ₹4,00,000 | Guaranteed doubling of money |

What is the Kisan Vikas Patra Scheme

Kisan Vikas Patra is a small savings scheme operated by the Post Office under the Ministry of Finance. Originally meant to support farmers, it is now available to all Indian citizens. The objective of this scheme is straightforward: your deposited amount doubles after a fixed duration, making it a practical choice for people who want steady, risk-free growth without market fluctuations.

Current Interest Rate on KVP

The government revises KVP interest rates every quarter. At the present rate of 7.5 percent per annum, the invested amount takes 115 months to double, which equals around 9 years and 7 months. Thus, investing 2 lakh today ensures a guaranteed payout of 4 lakh at the time of maturity.

Minimum and Maximum Investment Limits

KVP is accessible for all types of savers. The minimum investment begins at 1000 rupees, and additional deposits can be made in multiples of 100. Since there is no upper limit, both small and large investors can use the scheme to grow their savings in a disciplined and secure manner.

How to Purchase KVP Certificates

Anyone can buy KVP certificates from any Post Office branch. You need to submit basic KYC documents such as Aadhaar, PAN, or Voter ID along with the application form. After verification and payment, the Post Office issues a certificate either digitally or physically, containing details like investor name, amount invested, date of purchase, and maturity value.

Eligibility to Invest in KVP

Any Indian citizen above the age of 18 can invest in KVP. Parents and guardians can also purchase certificates for minors. Joint investments by two adults are permitted as well. However, NRIs and Hindu Undivided Families are not eligible to invest in the scheme.

Premature Withdrawal Options

Although KVP is intended for long-term savings, withdrawal before maturity is allowed under specific circumstances. After a lock-in period of two and a half years, investors may withdraw the amount with adjusted returns. Premature encashment is also allowed due to reasons such as the investor’s death, a court order, or forfeiture by a pledgee.

Tax Implications for Investors

Kisan Vikas Patra does not provide tax deductions under Section 80C, and the interest earned is completely taxable. Even so, many investors continue to choose KVP because of its guaranteed returns and government backing, which provide reliability unmatched by many market-linked products.

Benefits of Investing in Kisan Vikas Patra

KVP remains a preferred option for middle-income families, senior citizens, and conservative investors due to its secure structure. Key advantages include predictable doubling of money, zero market risk, no investment limit, simple process, and easy transferability between post offices or individuals. These features make KVP a dependable tool for long-term financial planning.

Example of Returns on 2 Lakh Investment

If you invest 2 lakh rupees at the current interest rate, your amount will grow steadily and reach 4 lakh after 115 months. This predictable growth makes KVP suitable for planning future expenses such as children’s education, marriage funds, or retirement-related needs.

Final Verdict

Kisan Vikas Patra is one of the safest long-term investment schemes offered by the Post Office. Though it does not offer tax benefits, the assurance of doubling your money and government-backed protection makes it a strong option for individuals who prioritize security over high-risk returns. A 2 lakh investment growing into 4 lakh provides clarity and confidence for future financial planning.

Disclaimer

This article is for informational purposes only. Interest rates and scheme terms may change according to government notifications. Investors should verify the latest details from the official Post Office website or consult a financial advisor before making investment decisions.