Post Office FD Scheme 2025 Calculator: Fixed deposits in India have always remained a top choice for people who want steady, safe, and predictable returns. Among the various options available, the Post Office FD Scheme 2025 continues to attract investors because it is secure, government-backed, and suitable for individuals who prefer guaranteed income. With the help of the Post Office FD 2025 Calculator, anyone can quickly estimate how much their investment from ₹10,000 to ₹1 lakh will grow over different tenures.

Post Office FD Scheme 2025 Returns Table

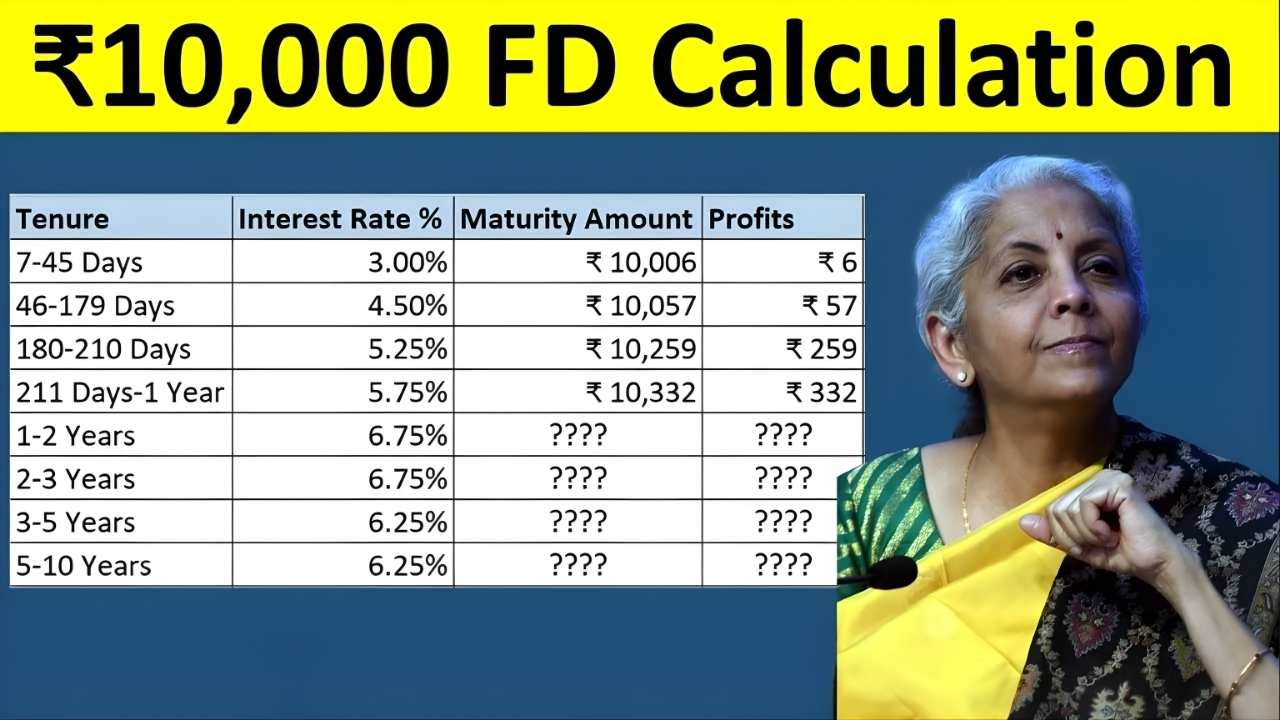

| Investment Amount | Tenure | Estimated Return Rate | Approx Maturity Value |

|---|---|---|---|

| ₹10,000 | 1 to 5 years | As per 2025 FD rates | ₹10,600 to ₹12,700 |

| ₹25,000 | 1 to 5 years | Depends on FD term | ₹26,500 to ₹31,700 |

| ₹50,000 | 1 to 5 years | Quarterly compounding | ₹53,000 to ₹63,500 |

| ₹1,00,000 | 1 to 5 years | Highest return for 5-year FD | ₹1,06,000 to ₹1,27,000 |

What is a Post Office Fixed Deposit

A Post Office Fixed Deposit is a government-supported savings instrument offered through India Post. Investors deposit a lump sum amount for a fixed time period and earn a guaranteed interest rate throughout the tenure. Since Post Office FDs are not influenced by market fluctuations, they provide reliable and consistent returns, making them ideal for people seeking secure financial growth.

Key Features of Post Office FD Scheme 2025

The Post Office FD Scheme 2025 offers several investor-friendly features. It is open to Indian residents, and minors can also hold FDs through a guardian. The minimum deposit starts at just ₹1,000, allowing even small savers to participate. The maximum deposit can go up to ₹15 lakh for a single account.

Tenure options range from one to five years, and the interest rate remains fixed for the entire duration. India Post revises FD interest rates periodically to ensure that investors receive competitive returns in the changing economic environment.

Using the Post Office FD 2025 Calculator

The Post Office Fixed Deposit Calculator 2025 is a simple digital tool that helps investors estimate their maturity amount. Users only need to enter the investment amount, number of years, and current interest rate. The calculator instantly displays the total interest earned and maturity value.

For example, if someone invests ₹50,000 for three years at the applicable rate, the calculator can compute the results within seconds. This tool is especially helpful for retirees, salaried professionals, young savers, and individuals planning short-term financial goals.

Interest Rates and Maturity Benefits

Post Office FD interest rates for 2025 are reviewed every quarter by the government to keep them attractive. Shorter tenures have slightly lower rates, while five-year deposits usually offer the highest returns.

Investors can choose between quarterly compounding or monthly interest payouts. Small deposits like ₹10,000 yield modest returns, while larger deposits such as ₹1 lakh can generate significantly higher maturity amounts, making them useful for financial planning.

Taxation on Post Office FD Interest

Interest earned on Post Office FDs is taxable under the Income Tax Act. Taxes may be deducted at source if the yearly interest crosses the prescribed limit. Although the principal amount does not qualify for tax deductions, many investors still prefer Post Office FDs due to their safety, predictability, and government guarantee.

Advantages of Investing in a Post Office FD

Post Office FDs offer complete safety as they are backed by the Government of India. They provide assured returns without any market-related risk. The scheme is flexible in terms of deposit amount, interest payout option, and tenure.

Additionally, the extensive network of post offices ensures that people from rural and urban areas alike can easily open and manage their FD accounts. This makes the Post Office FD Scheme 2025 a dependable investment choice.

Ideal Investors for the Post Office FD Scheme 2025

This FD scheme is a perfect fit for risk-averse investors. Retirees seeking regular and safe income, salaried individuals looking for a secure savings option, and parents building a fund for future needs can benefit from it.

It is also ideal for people who prefer government-backed financial products over bank FDs or market-linked investments.

How to Open a Post Office FD Account

Opening a Post Office FD account is simple. Visit the nearest post office, submit identity proof, address proof, and a filled application form. Investments can be made through cash, cheque, or bank transfer where available.

Once the FD is opened, the interest and maturity amount are calculated automatically based on the chosen tenure. Many post offices now offer digital services to track deposits, check interest calculations, and manage multiple FD accounts.

Final Verdict

The Post Office FD Scheme 2025 combined with the FD Calculator offers a safe, simple, and predictable investment option. Whether the investment amount is ₹10,000 or ₹1 lakh, returns can be estimated instantly, helping individuals plan their savings effectively. With its government backing, guaranteed interest, wide accessibility, and flexible features, the Post Office FD remains one of the most reliable investment instruments for conservative and long-term savers.

Disclaimer

This article on the Post Office FD Scheme 2025 is for general information and educational purposes only. Interest rates, eligibility rules, and FD guidelines may change based on official notifications from India Post or the Government of India. Investors should verify the latest details from authorized post offices or the official India Post website before making financial decisions.