Best Post Office Schemes in 2025: India Post has remained a reliable option for safe and government-backed savings for decades. Post Office savings schemes offer assured returns, tax benefits, and a variety of investment choices suitable for all age groups. In 2025, these schemes continue to attract conservative investors who prioritize capital protection over market-linked risks. Choosing the right scheme depends on your age, financial goals, and investment horizon.

Why Choose Post Office Schemes

The primary advantage of Post Office schemes is security. Since they are backed by the Government of India, there is minimal risk of default. These schemes are ideal for investors who prefer guaranteed returns over equity-linked risks. They also offer flexible options such as monthly income, long-term savings, retirement benefits, and tax exemptions under Section 80C of the Income Tax Act.

Best Post Office Schemes for Young Investors (Age 20–35)

Young professionals should focus on building wealth and cultivating disciplined saving habits. Post Office schemes complement other investment avenues like equities and mutual funds by providing a secure foundation.

Recurring Deposit (RD)

A Post Office RD allows a fixed monthly deposit for five years with quarterly compounding. It encourages regular savings and ensures steady growth without straining finances.

National Savings Certificate (NSC)

NSC is a five-year fixed-income investment offering attractive interest rates. It is ideal for salaried individuals seeking assured returns and tax savings under Section 80C. Reinvested interest further enhances maturity value.

Sukanya Samriddhi Yojana (SSY)

For parents of a girl child, SSY provides high interest rates and tax-free returns. The account can be opened before the girl turns 10 and continues until she is 21, securing her financial future.

Best Post Office Schemes for Mid-Age Investors (Age 35–50)

Investors in this age bracket often focus on balancing family expenses, children’s education, and long-term wealth creation. Stability and predictable returns are key.

Kisan Vikas Patra (KVP)

KVP doubles your investment over a fixed period, usually around ten years depending on prevailing interest rates. It is suitable for parking surplus funds safely.

Monthly Income Scheme (MIS)

MIS offers guaranteed monthly payouts from a lump sum investment. It is suitable for families seeking steady additional income while keeping capital secure.

Public Provident Fund (PPF)

PPF remains a popular long-term investment with a 15-year lock-in. It provides tax-free returns, government backing, and partial withdrawal options for emergencies.

Best Post Office Schemes for Senior Citizens (Age 50 and Above)

For seniors, capital security and regular income are priorities. Post Office schemes cater well to these requirements.

Senior Citizens Savings Scheme (SCSS)

SCSS offers higher interest rates for individuals above 60 years. The tenure is five years, extendable by three years, with quarterly interest payouts providing reliable income.

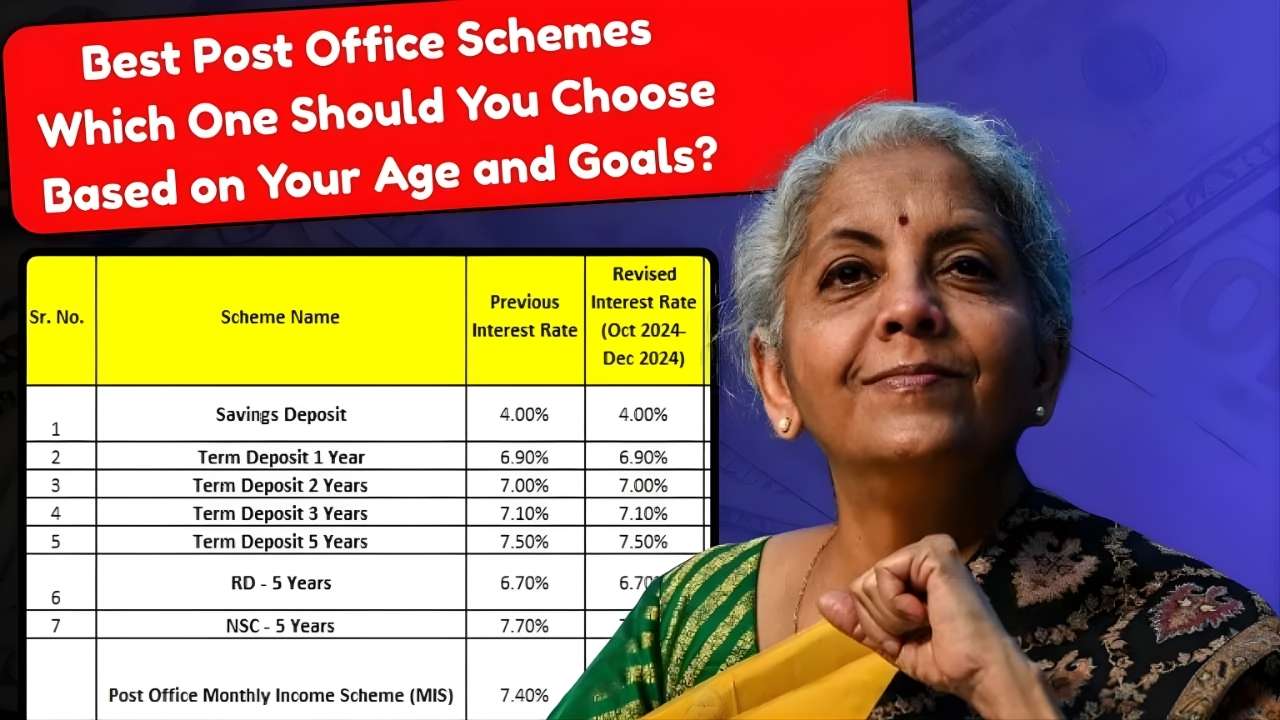

Post Office Fixed Deposit (FD)

FDs offer guaranteed returns with flexible tenures ranging from one to five years, ideal for those seeking short-term safe investments.

Monthly Income Scheme (MIS) for Pensioners

This variant of MIS provides fixed monthly income for retirees, ensuring financial stability without depleting savings.

Tax Benefits of Post Office Schemes

Most Post Office schemes qualify for tax deductions under Section 80C of the Income Tax Act, up to Rs. 1.5 lakh per financial year. Schemes like PPF and SSY also provide tax-free returns at maturity. MIS and SCSS interest is taxable, but the safety and guaranteed returns make them attractive for conservative investors.

Choosing the Right Post Office Scheme

Selecting the most suitable Post Office scheme depends on age and financial goals:

- Young professionals (20–35) can start with RD, NSC, or PPF for disciplined long-term savings.

- Mid-age investors (35–50) can diversify into MIS, KVP, and PPF to balance security with returns.

- Senior citizens (50+) should focus on SCSS and MIS for regular retirement income.

- Parents with daughters should consider SSY to secure the child’s future financial needs.

Final Verdict

Post Office savings schemes in 2025 continue to be one of India’s safest and most reliable investment options. By aligning your choice with your age, financial objectives, and risk tolerance, you can create a balanced financial plan that ensures guaranteed returns and tax benefits while minimizing exposure to market volatility.

Disclaimer

The information provided in this article is for educational purposes and general awareness only. Interest rates, benefits, and rules of Post Office schemes may change according to government notifications. Readers should verify the latest official information or consult a qualified financial advisor before making any investment decisions.