Post Office PPF Scheme Invest: The Post Office Public Provident Fund (PPF) is one of India’s most reliable long-term saving instruments. With government protection, assured interest, and complete tax exemption, PPF continues to be a favorite among salaried individuals, self-employed professionals, and families seeking stable financial growth. Many people are surprised to learn how a small contribution of ₹25,000 per year can accumulate into a sizable corpus over time thanks to compounding and tax-free returns.

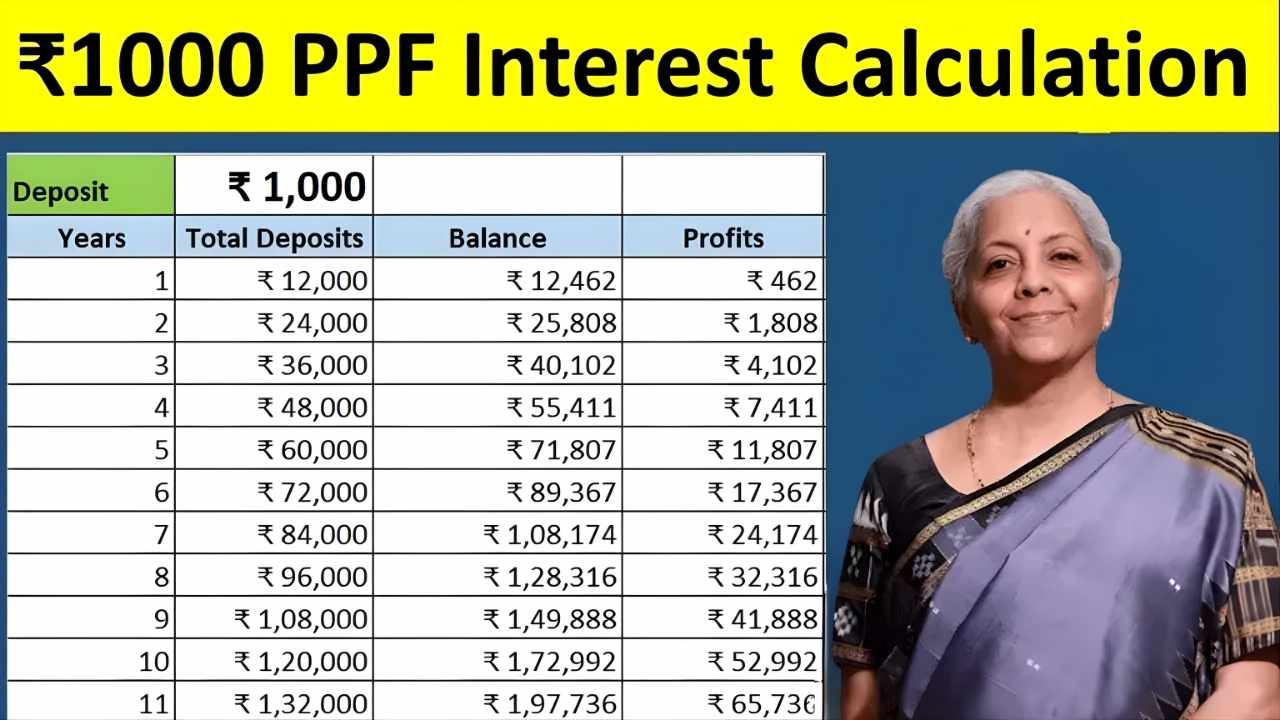

Post Office PPF Contribution to Maturity Table

| Annual Contribution | Tenure | Interest Rate | Approx. Maturity Amount | Interest Earned |

|---|---|---|---|---|

| ₹25,000 | 15 Years | 7.1% | ₹6,78,035 | ₹3,03,035 |

| ₹50,000 | 15 Years | 7.1% | ₹13,56,070 | ₹6,06,070 |

| ₹1,00,000 | 15 Years | 7.1% | ₹27,12,140 | ₹12,12,140 |

| ₹1,50,000 | 15 Years | 7.1% | ₹40,68,210 | ₹18,18,210 |

This table highlights how different contribution levels can significantly influence maturity value, especially under a long-term scheme like PPF that grows through annual compounding.

What is the Post Office PPF Scheme?

The Public Provident Fund is a long-term savings initiative launched in 1968 to help citizens build a secure financial foundation. It can be opened at both banks and post offices, providing widespread availability. The scheme runs for 15 years, and investors have the option to extend it in blocks of 5 years thereafter.

Known for tax-free returns and guaranteed interest, PPF falls under the EEE (Exempt-Exempt-Exempt) category, meaning the investment amount, interest earned, and maturity proceeds are all exempt from income tax.

Current Interest Rate on PPF

PPF interest rates are reviewed quarterly by the government. At present, the scheme offers an annual interest rate of 7.1 percent. The interest is calculated yearly but compounded annually, allowing even small contributions to grow meaningfully by the end of the maturity period.

Minimum and Maximum Investment in PPF

The scheme is flexible enough to accommodate all types of savers. The minimum yearly deposit is ₹500, while the maximum allowed in one financial year is ₹1.5 lakh. Investors can deposit either in one lump sum or in up to 12 installments within a year.

How ₹25,000 Grows Into ₹6.78 Lakh

If an investor adds ₹25,000 every year for 15 years, the deposit benefits from annual compounding at 7.1 percent interest. By the end of the tenure, the total maturity value reaches approximately ₹6,78,035. This includes both the principal and interest earned over the years.

This demonstrates the impact of consistent saving combined with compounding small annual contributions can grow into a substantial amount over time.

Tax Benefits of PPF

One of the biggest advantages of PPF is its tax benefit under Section 80C of the Income Tax Act. Deposits up to ₹1.5 lakh per year qualify for tax deduction. Additionally, the interest gained each year and the final maturity amount are completely exempt from tax, making PPF one of the most tax-efficient investment options in India.

Rules for Withdrawal and Loan Facility

Even though the PPF account has a lock-in period of 15 years, partial withdrawals are permitted from the 7th year onwards under specific conditions. Investors can also avail loans between the 3rd and 6th year of the account, offering a low-interest borrowing option without breaking their savings.

Extension Options After 15 Years

After completing the initial 15-year period, investors may choose to extend their PPF account in 5-year blocks. During extension, they may continue depositing funds or simply let the existing balance earn interest. This makes PPF a powerful long-term wealth-building tool and a preferred choice for retirement planning.

Safety and Reliability

Being a Government of India-backed scheme, PPF offers complete safety with no risk of default. Unlike market-linked investments such as equity or mutual funds, PPF returns remain unaffected by market volatility, ensuring stable growth.

Who Should Invest in PPF?

The PPF scheme is ideal for:

- Salaried employees planning long-term savings

- Self-employed individuals who do not have EPF

- Parents saving for children’s future education or marriage

- Risk-averse investors who prefer guaranteed returns

- Anyone seeking tax-free and stable growth

Examples of Higher Contributions

While ₹25,000 annually can yield ₹6.78 lakh, increasing contributions can create even larger wealth. For instance, investing ₹1.5 lakh annually the maximum limit can generate over ₹40 lakh in 15 years at the same interest rate. This highlights the immense potential of disciplined long-term saving.

Final Verdict

The Post Office PPF Scheme continues to be one of the safest, most rewarding, and tax-efficient long-term investment plans in India. With an annual deposit of ₹25,000, investors can accumulate around ₹6.78 lakh in 15 years completely tax-free. Backed by guaranteed interest, compounding benefits, and government security, PPF remains an ideal choice for anyone looking to secure their financial future with low risk and stable growth.

Disclaimer

This article is intended for educational and informational purposes only. Interest rates, rules, and maturity values related to the Post Office PPF Scheme may change based on government notifications. Investors should verify the latest details from official India Post or Ministry of Finance sources before making any financial decision. The author or publisher is not responsible for any financial loss arising from reliance on this information.